The question I get most often is ‘how often can I apply for a new credit card?’. Naturally the underlying question is how quickly can one get enough frequent flyer points for a First Class flight.

In this post:

How Often Can I Apply For A New Credit Card?

Providing you have a Very Good or Excellent credit score, you should be able to get approved for a new credit card every 3-4 months in Australia.

That time allows you to meet minimum spend for the bonus points, see them credited to your frequent flyer account and your credit score to recover.

Will Applying For Many Credit Cards Affect My Credit Score?

Yes, all major financial institutions in Australia use credit reporting bureaus like Equifax (formerly Veda) as part of the credit decision. Each ‘pull’ of your credit profile will reduce your score so only apply for credit cards with the highest bonuses.

How Do I Find My Credit Score For Free?

Given how critical your credit score is to getting approved for a new credit card, everyone should know their scores. Fortunately, you can get your credit score for free for all three credit bureaus.

Equifax (Formerly Veda)

Get instant free access to your Equifax credit report via getcreditscore.com.au. The site is backed by peer-to-peer lender SocietyOne.

Experian

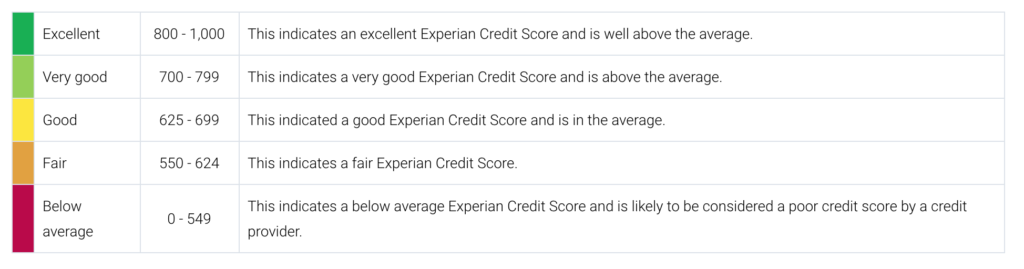

Get instant free access to your Experian credit report via creditsavvy.com.au. The site is backed by the Commonwealth Bank of Australia.

There is also a helpful guide on understanding your Experian score.

illion (Formerly Dun & Bradstreet)

Get instant free access to your illion credit report via creditsimple.com.au.The site is operated by illion directly.

How To Get Approved For A Credit Card?

Banks and financial institutions like American Express use a range of criteria to make a credit decision. Give yourself the best chance of being approved:

- Know your credit score so you only apply when your score is Very Good or Excellent

- Close unused credit cards to reduce your available credit limits as your full balance is considered ‘utilised’ for the purpose of credit assessment

- Reduce your home loan repayments to the minimum (temporarily) as your ability to service debt is calculated using the current repayment

Bottom Line

Credit cards and their frequent flyer sign on bonuses points are often the fastest way to a Business or First Class flight. By understanding your credit score and applying only every 3-4 months, you will give yourself the best chance of being approved.