CommBank has just launched a brand new product for travellers: the World Debit Mastercard. I was fortunate to be invited to use the card as part of a pre-registration offer that included six months for free. So that’s the catch, Commbank will charge you $10 per month to use the card.

Essentially, this is a premium card offering features that have traditionally only been available with credit cards.

It really is a beautiful looking card. It is orientated in a portrait format, rather than the usual landscape. I like the simplicity of design and colour. It also has a yellow strip around the edge, making it easy to find in your wallet.

As is the current trend, the embossing of the cardholder’s name and card number has been removed. However, two dots have been cleverly added at the bottom; this means that when you insert the chip you know which end to hold. This is great for the visually impaired, older folk and in low-light environments.

In this post:

Apple Pay, Samsung Pay and Google Pay supported

Another plus is that the World Debit Mastercard supports Apple Pay, Samsung Pay and (my favourite) Google Pay; these payment methods are so convenient as you never have to get your wallet out of your pocket.

Pros of the CBA World Debit Mastercard

It’s about time. Commbank has removed the fees for overseas transactions (although previously available on their now-defunct American Express). I’ve had an unfortunate experience shopping online with my older Commbank Mastercard. I thought I was paying in AUD but they charged me 3% as the purchase was from a foreign merchant.

Two lounge passes come with the World Debit Mastercard that can be used at more than 1,000 airport lounges. These are great for those times you are flying economy (think intra-Europe) on a non-Oneworld carrier. I have the same offer on my Westpac Altitude credit card.

There are also exclusive Mastercard offers at the airport and elsewhere. I’ve found these underwhelming over the years, so I’ll be interested to see if this changes.

Access to Mastercard Global Services for emergency cash is also available.

The World Debit card offers insurance for both travelling and purchases, not normally available with debit cards. I have claimed on similar insurance, once when I broke my glasses and another time when my wife’s wallet was stolen. However, as I have many other credit cards with the same offer, this is a marginal benefit.

Importantly, this card gives you access to your own money. This is a big deal as you don’t need to transfer between banks to avoid international fees.

Cons of the CBA World Debit Mastercard

When compared to the pros, the cons seem very limited. The only two I could see are

- The monthly fee of $10 is mildly annoying.

- There are no frequent flyer points to be earned with card usage.

I think the World Debit Mastercard is a game changer for frequent travellers; it will be interesting to see if the other Big Four banks follow suit.

I recently reviewed the UBank Debit card, which I may now ditch.

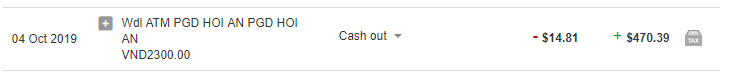

Update: Choose the credit button not the debit button when making cash withdrawals

I recently used this card at an ATM in Vietnam. After a number of rejected attempts when pressing the Debit button, I had success using the credit button.

While CommBank did not charge a fee, the bank in Vietnam charged VND30,000 or less than $2. So not quite fee free!!

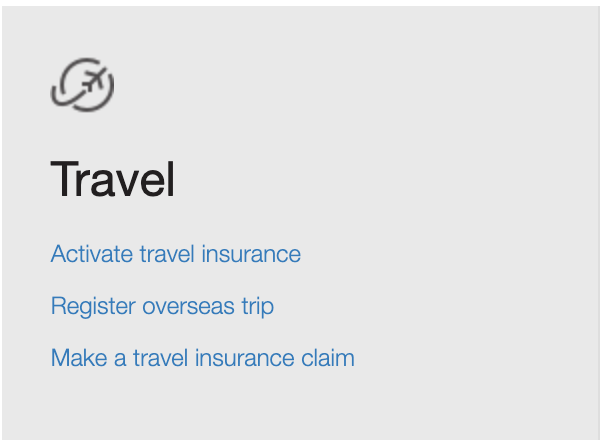

Update: How to activate Insurance with World Debit Mastercard

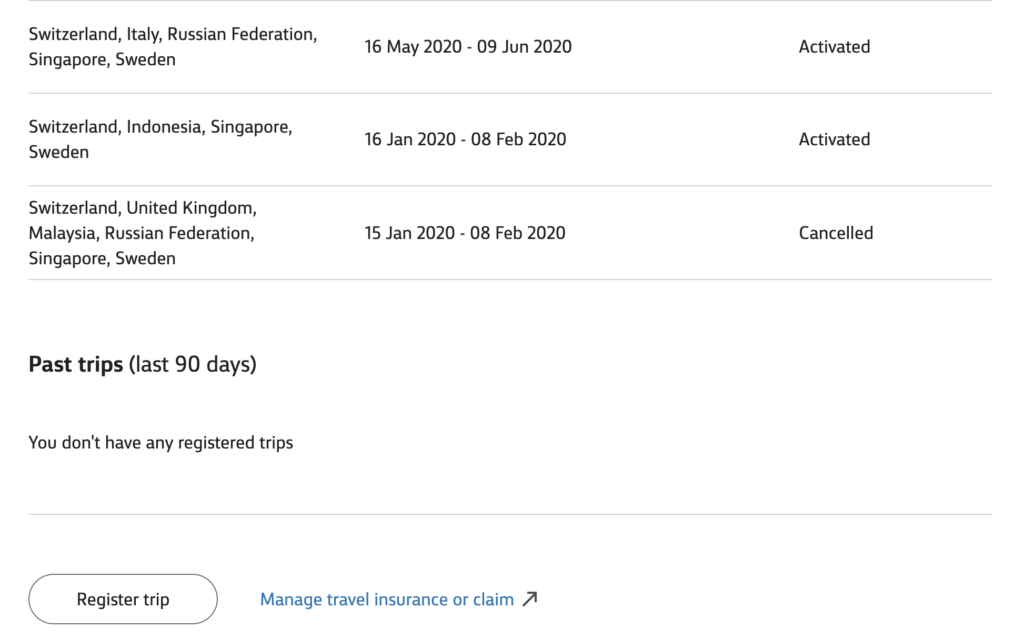

Before you leave Australia you must activate your Insurance in four easy steps:

1. Logon to NetBank

2. Navigate to settings on the top right hand side

3. On the bottom right click on “Activate travel insurance” in the grey box

4. You can then see your existing and cancelled policies and register your new trip.

From this page you can also update your trip with any changes. I always include any stopovers no matter how long just to be sure.

The great thing about CommBank travel insurance is that it is easy to access your policy details. both before you leave and when you are travelling. They also have a convenient online portal for insurance claims.

You will get emailed a copy of your insurance (and any changes that you make) plus can even get a copy sent to your home address.

Update: How to access a lounge using Lounge Key and Mastercard Airport Experiences

I finally had the opportunity to use my free lounge access. It was a simple process, firstly you need to register with Mastercard Airport Experiences. This will show you how many passes you have available. You can then use the search function to see if there is a lounge at the airport your are visiting. Then present yourself, your boarding pass and your CommBank World Debit Mastercard to the lounge check in . The lounge will confirm your details on a dedicated terminal and let you into the lounge. We successfully did this at Penang International Airport.

Summary

This is a clever card from Australia’s largest bank and sets a high bar both in design and utility. I plan to use the card over the next six months to see if it does represent value.

If you are looking for a Credit Card with similar features Commbank have launched the Ultimate Awards Credit Card, with fee free international transactions, paid lounge access and the same travel insurance.

Tip: Check the expiry date on your debit card before you travel (my daughter got caught out on this one). This card is good until August 2022. Also, try to get on the pilot so that you can get the six months free.

Interesting product about 3 years too late I think Drew. To your point, good for those who don’t like credit, but for the truly savvy, loading cash onto an ANZ Travel Adventures card would be a way better option. Coupled with 2x lounge passes, 0% FX free, ability to earn capped Velocity points, no ATM withdrawal fees (including intl) and a domestic return flight is worth the extra $85 cost p.a.

Look forward to your next review!

Thanks Jeff… yes I plan to write a post on that card, have been testing it out for the last 2 months as part of my Virgin/Singapore points plan… this card works for those who dont want a credit card…

It is wrong for bank to have invites only for debit cards,should be open for all of the public

where is the regulator,

Hi Scott..I suspect it will be open for the public eventually. Lets wait and see.

What are the exchange rates like though. Finding it hard to find any information on this

Hi Nicole, my understanding is that it is set by Mastercard so is the same as you would get from other cards, just without the bank add on fee. The link can be found here: https://www.mastercard.us/en-us/consumers/get-support/convert-currency.html I used it in Vietnam and was happy with the rate. Although the other bank charged a small fee. Hope that answers your question. Drew

Is this card still available? The link is still active on the commbank website, but there’s no obvious way of applying for the card.

Hi James, I suggest you call commmbank. I agree I could not find an obvious application. Mine still works though!