The Commonwealth Bank Ultimate Awards Credit Card is a new card that can be a great choice for regular travellers and big overseas spenders. It provides all the advantages of a premium credit card and, with planned spending, can be fee free.

In this post:

Hero Benefits of the CommBank Ultimate Awards Credit Card

The two hero benefits include fee free international transactions and a great travel insurance offering. For every $10,000 in international purchases you save around $300. When you consider the cost of an annual holiday for four the benefit can quickly add up. While overseas travel is no longer on the top of everyone’s list at the moment, it will be again eventually.

How to get the Ultimate Awards Credit Card for free?

To take advantage of the fee free offer you need to spend $2,500 per month and turn off paper statements otherwise you will be charged a $35 per month fee. This monthly fee is an interesting twist away from the usual annual fee. When you get charged the fee it can be a monthly reminder to keep spending.

While they have a special offer for new customers it is very easy for existing customers to switch to the new card. You will also lose any existing fee free benefits such as Wealth Package.

How do I switch to the Ultimate Awards Credit Card?

You can follow the link from the Commbank.com.au which will allow you to login to NetBank, accept the term and conditions and switch to the new card.

Before making the switch set up all your charges to another credit card. I set up all my direct debits to my Westpac Altitude Black so I would not miss a payment.

Pros of the Commonwealth Bank Ultimate Awards Credit Card

- Fee free international transactions and international purchases,

- 0.8 Qantas points per dollar spent for everyday purchases,

- Bonus points for international transaction @ 1.2 Qantas points per dollar spend,

- International travel insurance with a printable policy,

- Additional security with lock block and limit for purchases, and

- Apple and Google Pay included

Cons of the Commonwealth Bank Ultimate Awards Credit Card

- If you are on a free credit card program with your home loan you lose that benefit,

- Points radically reduce after you spend $10,000 per month,

- You need to spend at least $2,500 per month or you will pay a monthly $35 fee. Easy for some harder for others, and

- While they include free membership of Mastercard Airport Experiences for lounge access, at USD$32 per visit it provides borderline benefit. My experience at the Plaza Premium Lounge Penang was not USD32 of value.

Should I switch to the Ultimate Awards Credit Card?

It depends on your situation but if you don’t have a fee free card, spend a lot in a foreign currency and can manage your spending, then the Awards Credit Card is worth considering. As mentioned you need to ensure your $2,500 each month.

How many points do you get?

This is a classic opaque credit card that makes it hard to determine how many points you will actually get. Based on my spend I would get around 0.8 Qantas Frequent Flyer points per dollar spend vs 1.2 with my Amex Qantas Ultimate card. As I never use my Amex while travelling and many shops decline it for large transactions I am OK with the slightly lower points.

Unlike Amex the points drop quickly once you spend over $10,000. You do need to manage your spend accordingly.

What are the other Alternatives

You could just pay the international transaction fee on a regular card, however this can build up very quickly. The ANZ Tavel Adventures card is also in my wallet. It offers fee free international transactions and has a small annual fee offset by a free Virgin flight each year and includes Virgin lounge access. This card is now redundant so once I claim my free flight I plan to close this card.

Of course you can skip points and fee free days altogether and use your own money with a fee free UBank or ING Debit card.

How is it different to the World Debit Mastercard card

The CommBank World Debit Mastercard and the Ultimate Credit Card are nearly identical in features and appearance. They are both in landscape rather than portrait, don’t have any embossing, have a unique raised dot to make it easy to insert into chip devices and a yellow centre. In my wallet they look almost identical, which can be a problem.

The World Debit includes fee free international transactions, two Mastercard Airport Experiences lounge access passes and the same travel insurance. However the World Debit Card costs $10 per month with limited opportunity for a fee waiver. I plan to close this card as the only added benefit is lounge access.

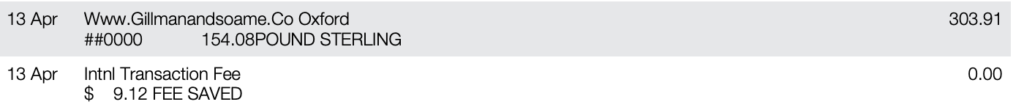

Update: How Much Money Will I Save On Foreign Exchange Fees

You should save three percent on every foreign exchange transactions. This can either be when travelling overseas or for online purchases.

The example below shows a $9 saving on a $300 bag. One trap is many websites are not clear on the currency. This example was an AU website billing in USD.

The other neat feature of the card is on the statement which shows how much you saved in foreign exchange fees.

Summary of the Ultimate Awards Credit Card

After writing this review I could close three cards I currently use and replace with this one card. I decided to make the switch to the CommBank Ultimate Awards credit card even though I was foregoing a lifetime free benefit. The free international transactions, great servicing through NetBank and compelling insurance won me over. I just need to spend $2,500 per month on the card which currently is very easy.

Thanks for the information, I just got my ultimate award card, on your opinion is it worth to subscribe on Qantas points for less points (0.8 for every dollar) or just collect the normal award points (up to 3points for every dollar) to spend at Flight centre?

Thank you

Hi Maykon, It really depends on where you want to go. Business Class International awards points are rare as hens teeth, while domestic is pretty good. The advantage of flight centre is you can use for accomodation rather than just flights. I personally keep pouring into points and never redeem for coupons. Hope that helps

Hi Drew,

Thanks for all the advice thus far on this thread.

If you know; or are willing, could you please help me with the following question.

If my business spends 150k – 200k at a domestic Melbourne trade wholesaler how many Qantas points will I accrue a month and are they capped or do they expire?

Apologies for the long question but would love an answer if you have a general idea.

Thanks 🙂

Hi. Just wondering can you withdraw cash from your ultimate credit card? Thanks